Ad valorem tax calculator

Given Assessed value of transaction 10000 Sales tax rate 20. Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the.

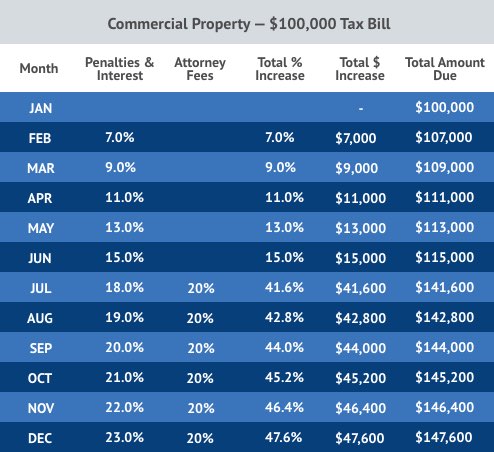

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

0 on vehicles priced at 4000 or less.

. Ad Valorem Tax For purposes of assessment for ad valorem taxes taxable property is divided into five 5 classes and is assessed at a percentage of its true value as follows. View pg 1 of chart find total for location. Determine the sales tax that has to be paid in the given country for a sales transaction of 10000.

The Vehicle License Fee is the portion that may be an income tax deduction and is what is. Visit The Official Edward Jones Site. This Supplemental Tax Estimator is.

66 Title Ad Valorem Tax TAVT. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages. Arkansas plus 65 on balance total.

This calculator is an estimating tool and does not include all taxes that may be included in your bill. Title Ad Valorem Tax TAVT - FAQ Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax. Motor Vehicle Ad Valorem Taxes.

Ad valorem tax is a property tax not a use tax and follows the property from owner to owner. New Look At Your Financial Strategy. Your annual vehicle registration payment consists of various fees that apply to your vehicle.

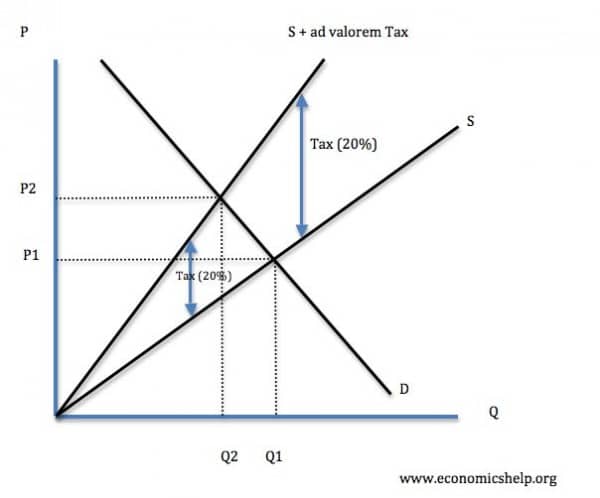

This comparison can then be used to see an. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

You may visit the Title Ad Valorem Tax Calculator to compare the current annual ad valorem tax and the new one-time Title Fee. Therefore unlike registration fees taxes accumulate even when a vehicle is not used on the. Dallas County Ad Valorem Tax Calculator Dallas County Property Tax Calculator This calculator uses 2021 rates derived from the Dallas County Appraisal District DCAD website on.

Generally the TAVT is calculated by multiplying the applicable rate times the Fair Market Value FMV as defined by law. The most common ad valorem taxes are property taxes levied on. The ad valorem calculator can estimate the tax due when purchasing a vehicle of any sort.

How is ad valorem tax calculated Georgia. If the sale included a trade-in the FMV is first reduced by that. This calculator can also help estimate the tax due if a car is transferred from one.

Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value. This could be listed on your tax. The tax assessors value of your property.

The Supplemental Tax Estimator provides an estimate of supplemental taxes along with an estimate of property tax liability for the following tax year.

Ad Valorem Tax Economics Help

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

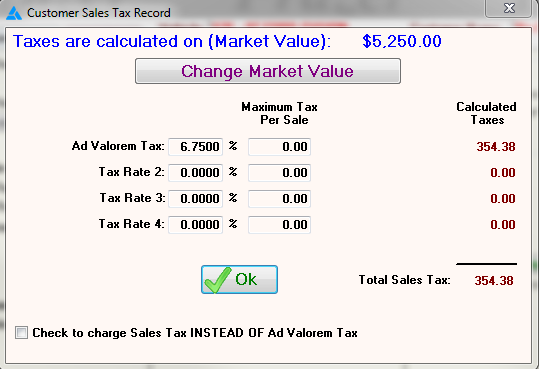

Frazer Software For The Used Car Dealer State Specific Information Georgia

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

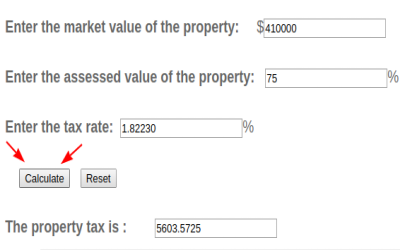

Property Tax Calculator

Property Tax Calculator Property Tax Guide Rethority

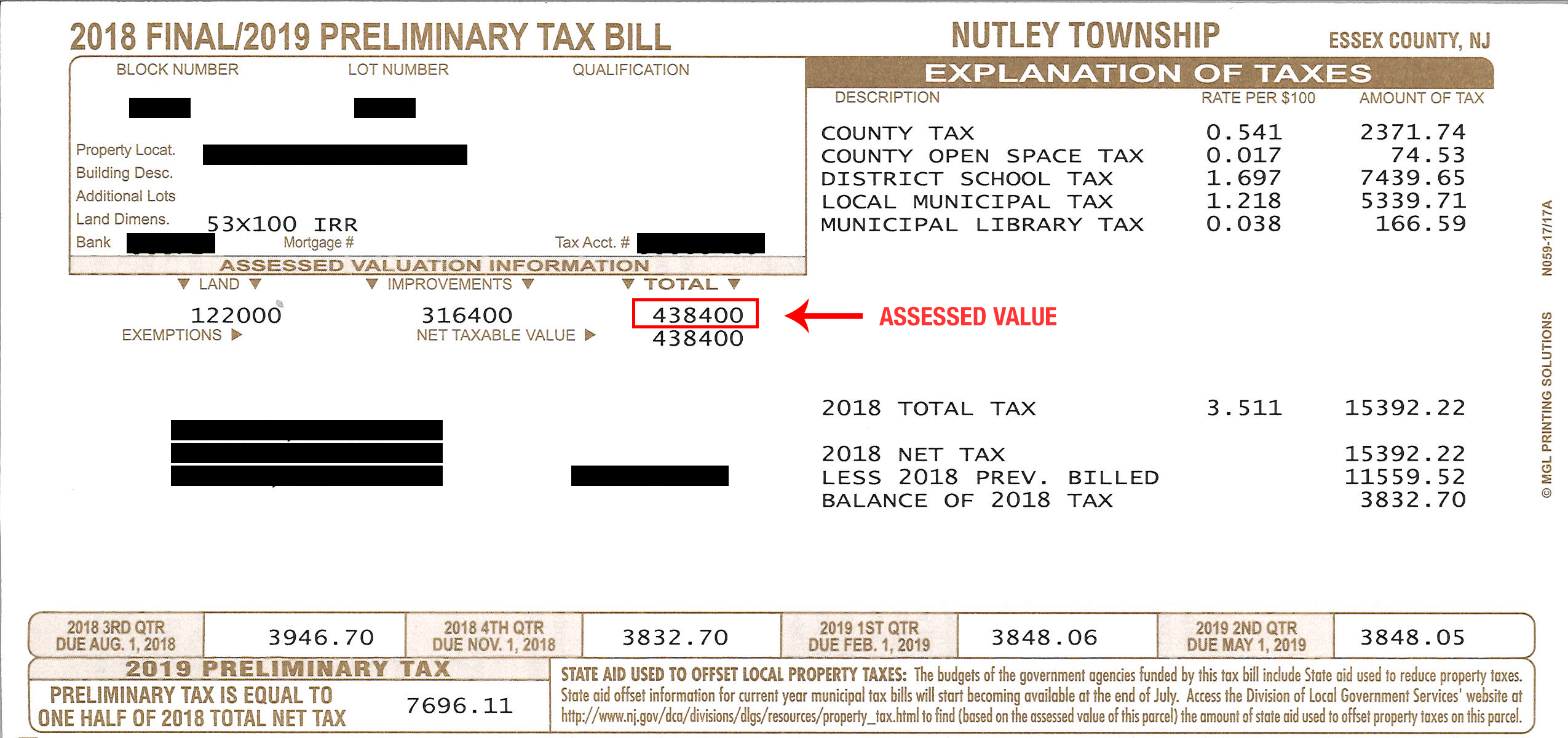

Township Of Nutley New Jersey Property Tax Calculator

The Property Tax Equation

Real Estate Property Tax Constitutional Tax Collector

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

Tax Rates Gordon County Government

New York Property Tax Calculator 2020 Empire Center For Public Policy

Tax Rates Gordon County Government

Understanding California S Property Taxes

Property Tax Calculator Property Tax Guide Rethority

Property Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator